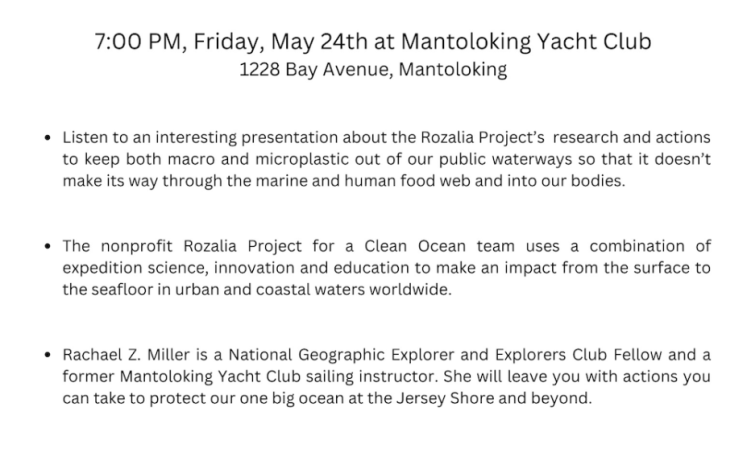

Update: Presentation by Rachael Z. Miller- Expedition sailing, science and solutions for a clean ocean! »

Date: Friday, May 24, 2024Location: Mantoloking Yacht Club- 1228 Bay Avenue, Mantoloking NJ 08738 Time: 7:00 p.m.**...

IMPORTANT REMINDERS FROM THE TAX OFFICE »

The 2024 Sewer Billings are due April 20, 2024 with a ten-day grace period. Interest will accrue at 12% after...

REMINDERS FROM THE TAX OFFICE »

The 2024 Sewer Billings are due April 20, 2024 with a ten-day grace period. Interest will accrue at 12% after...

4/4/2024

Hello Everyone,

As many of you may know there has been considerable discussion regarding the installation of speed humps in town on Barnegat Lane. We have done a traffic report as well as studying this topic for many months.

The survey indicated that we do not have a speeding problem on Barnegat but we do have a congestion issue that is concerning from a safety perspective. When we see walkers and bike riders 3 and 4 abreast on the street along with cars moving north and south (some of whom have already been in traffic for an extended period of time) we have a recipe for a serious incident. The principal goal of the humps is to calm things down and allow people to be more aware of what’s going on around them.

We have decided not to install the humps by summer because we feel that the time needed for this project could have us paving Barnegat in the middle of the summer. We have also decided not to install the temporary speed bumps at all.

We do have maps that will show exactly where the humps will be placed along with the properties on either side of them north and south as well as the east and west sides on the street. Copies of the maps will be available in the Borough meeting room tomorrow Friday April 5th from 10:00 – 4:00. If you would like to see them next week just call Beverley, our clerk, at 732-475-6983 Ext 313 and she will show them to you at your convenience. This information will also be on the Mantoloking.org website.

I very much hope you will feel free to contact me if you have any questions or comments whatsoever.

Thank you.

Best,

Lance White

Mayor

Cell- 732-606-6988, (O)- 732-475-6983 Ext. 302.