Flood Insurance

Flood Insurance:

Standard Home Owners Insurance DOES NOT Cover Floods!

Flooding is the most common and costly natural disaster in the United States, affecting every region and State. No home is completely safe from potential flooding.

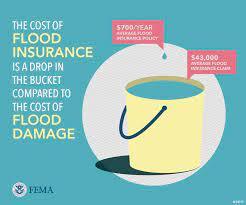

Flood insurance can be the difference between recovery or being financially devastated. Without flood insurance, most residents have to pay out of pocket or take out loans to repair and replace damaged items. With flood insurance, you're able to recover faster and more fully. Just one inch of water in a home can cost more than tens of thousands of dollars in damage—why risk it?

Separate coverage can be obtained for the building's structure and for its contents (except for money, valuable papers, and the like). The structure generally includes everything that stays with a house when it is sold, including the furnace, cabinets, built-in appliances, and wall-to-wall carpeting. There is no coverage for things outside the house, like the driveway and landscaping. Renters can buy contents coverage, even if the owner does not buy structural coverage on the building. Some people have purchased flood insurance because it was required by the bank when they got a mortgage or home improvement loan. If you have a policy, check it closely. You may only have structural coverage (because that's all that banks require).

For properties outside the mapped floodplain with no previous flood insurance claims, the National Flood Insurance Program also can provide coverage. It is designed to provide "peace of mind" to owners of homes subject to a lower flood risk.

Since the Borough participates in the National Flood Insurance Program (NFIP), flood insurance policies can be purchased for properties within the community. The agent who helps you with your homeowners or renters insurance may also be able to help you with purchasing flood insurance. If your insurance agent does not sell flood insurance, you can contact the NFIP Help Center at 800-427-4661. Flood insurance only covers damage when there is a general condition of surface flooding in the area. Please visit https://www.fema.gov/flood-insurance for more information.

GET FLOOD INSURANCE!!!

Community Rating System:

Communities that regulate new development in their floodplains are able to join the National Flood Insurance Program (NFIP), which in turn, provides federally backed flood insurance for properties in participating communities. To qualify for the NFIP, a community adopts and enforces a floodplain management ordinance to regulate development in flood hazard areas. The objective of the ordinance is to minimize the potential for flood damage to future development. Communities can be rewarded for doing more than simply regulating construction of new buildings to the minimum national standards required by the NFIP through was is called the Community Rating System (CRS).

The CRS is a part of the NFIP and reduces flood insurance premiums to reflect what a community does above and beyond the NFIP’s minimum standards for floodplain regulation. The objective of the CRS is to reward communities for what they are doing, as well as to provide an incentive for new flood protection activities. The benefits of CRS participation go well beyond the award of flood insurance premium discounts to policy holders in return for the implementation of specific floodplain management activities. The CRS is also a catalyst to the integration of a wide range of disaster resistance programs, improved knowledge of flood risk, and skills development. The CRS drives greater coordination among mitigation programs and enhanced awareness of the many actions communities can pursue to reduce losses and protect floodplain functions.

We have partnered with several local insurance companies through the NJ Coastal Coalition to provide technical assistance with understanding your flood insurance policy and how your premiums are calculated. You can contact Risk Reduction Plus (https://yourfloodrisk.com/) at 866-599-7066. Have your Elevation Certificate and your Insurance Policy with you when you call. Any other insurance companies that want to assist our community in this outreach efforts please contact NJ Coastal Coalition at acmcoastalcoalition@gmail.com.

The reduction in flood insurance premium rates is provided according to a community’s CRS classification. Based upon the total score for the credited activities it conducts, a community receives a CRS classification. There are 10 CRS classes: Class 1 requires the most credit points and gives the largest premium reduction (up to 45%); policy holders in a Class 9 community receive the smallest reduction (5%).

The Borough has achieved a rating of Class 7 under the CRS, resulting in a total premium reduction of 15% for policyholders within the Borough. Please provide this document listed below (CRS Discount Form) from the NFIP CRS Eligible Communities 10/2023, as support of the Borough’s CRS Classification when reviewing flood insurance policies with your insurance agent/adjuster.

| Attachment | Size |

|---|---|

| 62.16 KB |